TAA Compliance Simplified

by Emma Frisch, Law Clerk

International Trade Law

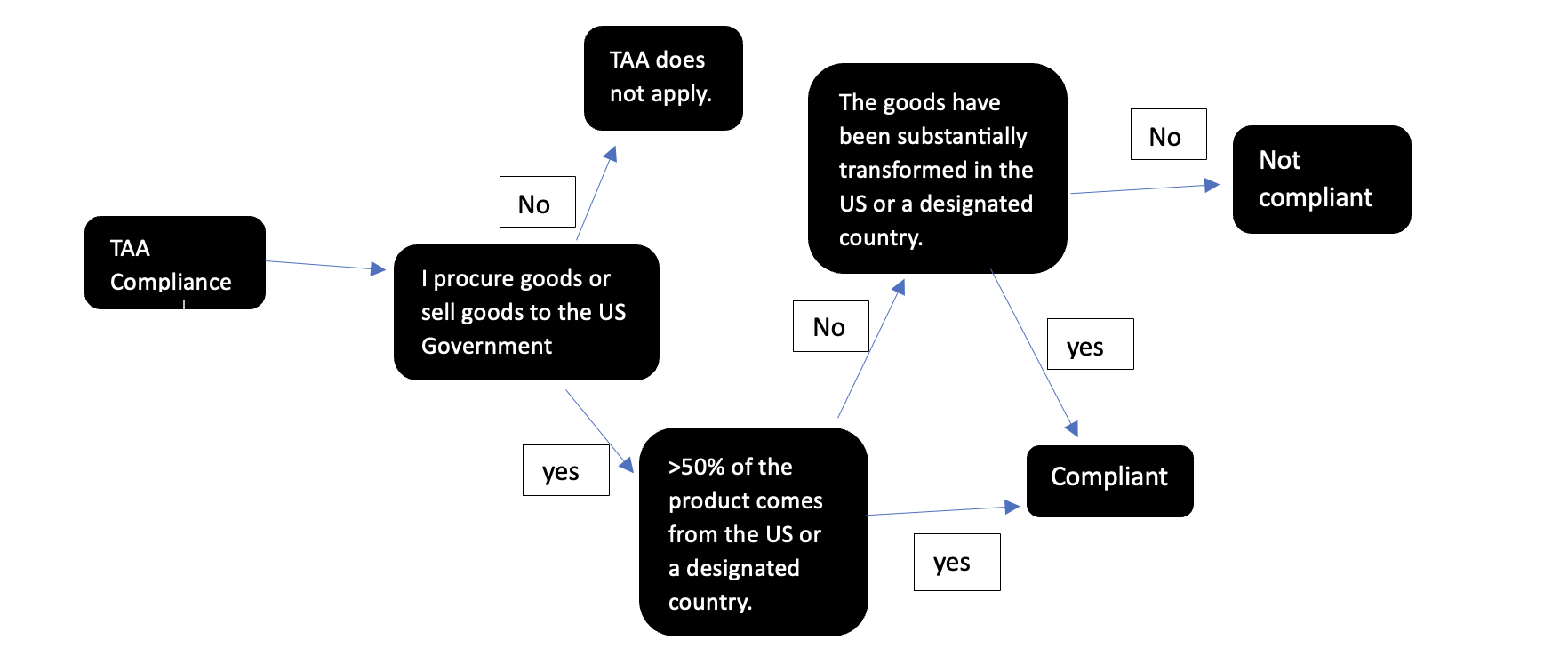

This blog aims to simplify which rules apply to companies that procure goods for or sell goods to the US Government. Here is a flow chart to help assess whether TAA applies to you and whether you’re compliant:

Who does the TAA apply to? The short answer is that the TAA (Trade Agreements Act) applies to products intended for US Government Procurement. The TAA limits procurement to products that are either US-made or from a “country of origin” that is a “designated country”. TAA also applies to GSA Schedule Contracts, affecting businesses that intend to sell goods to the US Government.

What are “rules of origin and their effect? The concept of “rules of origin” is central to international commerce. These rules are used to determine where a product comes from (i.e., the country of origin) for the purpose of tariff classifications and assessing import duties. If you want to reduce costs in your supply chain, consider sourcing products from a country that has low or no tariffs; these are referred to as “designated countries” under the TAA, or as FTA (Free Trade Agreement) countries in other circumstances where the TAA does not apply.

Where can I find out which countries qualify for lower tariffs? A full list of TAA “designated countries” is available at FAR 52.225-5 Trade Agreements and can be found at the end of this blog for convenience. Fun fact, Hong Kong and Taiwan are designated countries under the TAA. They are viewed separately from China for this limited purpose.

How can products be TAA compliant? Products can be TAA compliant in two ways: by meeting the country of origin threshold for inputs to the product or through undergoing “substantial transformation”. The thresholds under the TAA stipulate that at least 50% of the products overall manufacture cost must originate from the US or a designated country. This threshold rule is why products can have many sub-components from China but may ultimately be classified as from the United States or elsewhere. For example, you are manufacturing cars and the wheels come from China, the paint comes from Mexico, the radio system comes from Germany, and the remaining car parts are sourced from with the United States. This would be a TAA compliant car because more than 50% of the inputs are sourced from the United States or a designated country (i.e., Mexico and Germany).

What is “substantial transformation” and how does it work? The internationally recognized principle of substantial transformation applies when the product is made up of multiple components that come from different countries. Under the TAA, an item has been substantially transformed in an FTA country into a new and different article of commerce with a name, character, or use distinct from that of the article or articles from which it was transformed. The term refers to a product offered for purchase under a supply contract, but for purposes of calculating the value of the end product includes services (except transportation services) incidental to the article, provided that the value of those incidental services does not exceed that of the article itself (FAR 52.225-5(a)). To use the car example again, each of the subcomponents of the car are substantially transformed into a new product when they are combined resulting in a new classification that encompasses the result of the manufacturing process: the classification would be a vehicle, not the individual parts within it.

Perhaps the true value of your products isn’t derived from its physical attributes and instead it comes from the software, what then? Well, uploading software on certain products can be sufficient to warrant a substantial transformation. For example, a blank computer diskette is transformed when a software program is copied onto it. US Customs and Border Patrol (CBP) has determined that the character of the diskette is changed from one of a blank storage medium to one with a predetermined electronic pattern encoded onto it (HQ 735409 (May 27, 1994); HQ 735281 (Feb. 24 1994); HQ 732087 (Feb. 7 1990)). In this situation, the country of origin would be wherever the software was developed and uploaded onto the product because the software becomes the defining characteristic.

Lastly, routing the products through a designated country in an attempt to mask the country of origin will not work. This is called “re-exporting” and there are specific rules that govern this practice, none of which change the country of origin. Should you have further questions, don’t hesitate to contact one of our experienced TAA/BAA lawyers.

_________________________

Designated country means any of the following countries:

(1) A World Trade Organization Government Procurement Agreement (WTO GPA) country (Armenia, Aruba, Australia, Austria, Belgium, Bulgaria, Canada, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hong Kong, Hungary, Iceland, Ireland, Israel, Italy, Japan, Korea (Republic of), Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Moldova, Montenegro, Netherlands, New Zealand, North Macedonia, Norway, Poland, Portugal, Romania, Singapore, Slovak Republic, Slovenia, Spain, Sweden, Switzerland, Taiwan (known in the World Trade Organization as “the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei)”), Ukraine, or United Kingdom);

(2) A Free Trade Agreement (FTA) country (Australia, Bahrain, Chile, Colombia, Costa Rica, Dominican Republic, El Salvador, Guatemala, Honduras, Korea (Republic of), Mexico, Morocco, Nicaragua, Oman, Panama, Peru, or Singapore);

(3) A least developed country (Afghanistan, Angola, Bangladesh, Benin, Bhutan, Burkina Faso, Burundi, Cambodia, Central African Republic, Chad, Comoros, Democratic Republic of Congo, Djibouti, Equatorial Guinea, Eritrea, Ethiopia, Gambia, Guinea, Guinea-Bissau, Haiti, Kiribati, Laos, Lesotho, Liberia, Madagascar, Malawi, Mali, Mauritania, Mozambique, Nepal, Niger, Rwanda, Samoa, Sao Tome and Principe, Senegal, Sierra Leone, Solomon Islands, Somalia, South Sudan, Tanzania, Timor-Leste, Togo, Tuvalu, Uganda, Vanuatu, Yemen, or Zambia); or

(4) A Caribbean Basin country (Antigua and Barbuda, Aruba, Bahamas, Barbados, Belize, Bonaire, British Virgin Islands, Curacao, Dominica, Grenada, Guyana, Haiti, Jamaica, Montserrat, Saba, St. Kitts and Nevis, St. Lucia, St. Vincent and the Grenadines, Sint Eustatius, Sint Maarten, or Trinidad and Tobago).