Cracking the Codes of Import and Export: HTS and ECCNs

by Emma Frisch, Law Clerk

International Trade Law

In the world of international trade, understanding and adhering to regulations is crucial for businesses. Two important designations in this realm are Harmonized Tariff Schedule (HTS) codes and Export Control Classification Numbers (ECCN).

Part One: HTS Codes

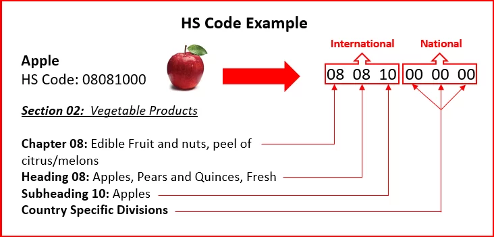

First, HTS codes are a standardized system used worldwide to classify traded products. These codes, often referred to as tariff codes, are essential for customs clearance and determining applicable duties and taxes. The HTS system is maintained by the World Customs Organization (WCO) to ensure consistency in trade classification.

Each product is assigned a unique HTS code based on various factors, including its composition, intended use, and technical specifications. These codes typically consist of numerical digits and can be quite detailed, providing a comprehensive description of the product. The use of HTS codes streamlines international trade processes, making it easier for customs authorities to identify and regulate goods crossing borders. Incorrect classification may result in delays, fines, or other complications.

Figure 1 Example of HTS code (Source: GCE Logistics)

Part Two: ECCNs

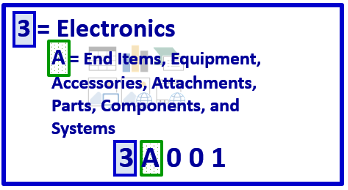

Second, ECCNs are another set of codes that play a vital role in international trade, particularly in the export of goods. ECCNs are part of the Commerce Control List (CCL), a list of items subject to export controls maintained by the U.S. Department of Commerce. ECCNs help identify products that may have restrictions or require specific licenses for export. The main differences to remember are that: HTS codes are used for import and ECCNs are used for export, HTS codes derive from a transnational system of rules and ECCNs come from US regulations. Further, Unlike HTS codes ECCNs are alphanumeric and consist of five characters. They are used to categorize goods based on their nature, destination, and end-use. The goal is to prevent the proliferation of sensitive technologies and ensure they do not end up in the wrong hands after leaving the United States.

Figure 2 An example of an alphanumeric ECCN (Source: BIS)

Businesses exporting goods from the United States must classify their products using ECCNs to determine whether an export license is required. This process is essential for complying with U.S. export control laws and regulations. Items with ECCN classifications such as “EAR99” may not require a license, while others may be subject to numerous restrictions. Export licenses are issued by the Bureau of Industry and Security (BIS).

In conclusion, both HTS codes and ECCNs are integral components of the international trade landscape. While HTS codes focus on import duties and taxes, ECCNs are crucial for controlling the export of sensitive technologies. Businesses engaged in global trade must navigate these coding systems diligently to ensure compliance with regulations and facilitate the smooth flow of goods across borders.

Questions? Don’t hesitate to contact one of our international trade attorneys – we would be happy to hear from you.